New York City Events this Fall

There is a long list of events lined up for this Fall: art, music, film, festivals and more… Surely an event for everyone! Let’s check out a few:

The New York Film Fest – From September 28 thru October 14, The Film Society of Lincoln Center will be hosting The New York Film Fest’s 50th anniversary. Top stars and filmmakers will be highlighted during the event along with full-length feature films, documentaries and more. The fest will kick off with “The Life of Pi,” a film by Ang Lee.

Coca-Cola Generations In Jazz Fest – Lincoln Center is currently serving as the home of jazz with Coca-Cola’s 3rd annual Generations in Jazz Festival. The event, which will run thru October 7, not only pays tribute to notable jazz legends, but encourages the development of young artists with the support of saxophone superstar, Pharoah Sanders.

Regarding Warhol: Sixty Artists, Fifty Years – This event, ending on December 31, is centered around artist extraordinaire, Andy Warhol. The exhibit will showcase Warhol's masterpieces alongside the works of approximately 60 contemporary artists that have been inspired by the Warhol model.

BAM's Next Wave Festival – This festival, ending January 29, 2013, fuses different forms of art: music, dance and film. Highlighted in particular are the final works of choreographer Pina Bausch alongside various esteemed filmmakers, composers and writers.

There is never a shortage of things to do in NYC. Let us know how you enjoyed these and what you have planned for the beautiful season!

Benefits of an Exclusive Buyer’s Brokers

In today’s wired world, there are countless resources and guides for prospective buyers to refer to. However, nothing can compare to having an experienced professional advising you on the best practices and hidden risks of purchasing a property. Having a professional on your side for a purchase that carries as much financial weight as it does emotional could save you unforeseen time and money.

The stakes are high, so let’s first understand the role of brokers. A buyer who contacts a broker to view a listed property is the listing broker’s customer. The listing broker, who has a fiduciary responsibility only to his client – the seller, is obligated to put the seller’s interests above that of all other parties.

Your most important investment deserves the same level of professional attention. An exclusive buyer’s broker will not only examine your cost vs. price, identify what you can afford and show you appropriate properties, he will help you weigh the many issues and circumstances that determine the best approach to negotiating the perfect property. This means your broker will fully consider your interests and nothing else. Having this invaluable asset when purchasing is a win-win – requiring little or no investment.

Here are just a few reasons why buying with The FARE Group® is the smartest choice when choosing the right broker for you:

BEST PRACTICES: Buying a home usually requires inspection reports, mortgage documents, insurance policies, deeds, contracts, etc. Your FARE Agent will help you prepare the best deal, and avoid costly delays or mistakes.

INSIGHT & EXPERIENCE: Most people buy only a few homes in a lifetime, usually with quite a few years in between each purchase. And even if you’ve done it before, laws and regulations change. In addition, there are many negotiating factors including price, financing, inclusions, exclusions, etc. We have experience navigating through various types of real estate transactions and having an expert by your side is critical.

EXTENSIVE RESOURCES: Sometimes the property you are seeking is available but not actively advertised on the market. The FARE Group® has the resources, know-how and time to find and investigate all available properties that fit your criteria. Additionally, The FARE Group® has access to over 30,000 property listings through its Residential Listing Service (RLS) and Multiple Listing Service (MLS).

OBJECTIVITY: A home often symbolizes family, rest, and security. Because of this, the process can be emotional for most people. Having a concerned, but objective, person by your side will help you stay focused on the issues that are most important to you. Our agents play this role while providing objective information about each property.

CODE OF ETHICS: The FARE Group® is a member of the Real Estate Board of New York (REBNY) and the Hudson Gateway Association of Realtors® (HGAR). Not all real estate practitioners are members of these prestigious real estate associations whose members subscribe to a strict Code of Ethics, based on professionalism and protection of the public. As a customer of The FARE Group® you can expect honest and ethical treatment in all related matters.

Your perfect property is waiting for you! Let a FARE Agent walk you through the process TODAY!

Home Sales Hit A 2-Year High!

The sales of existing homes hit a 2-year high last month. That, along with an increase in new home sales, reflect signs that the housing market recovery is gaining momentum!

According to the National Association of Realtors, existing home sales increased by 7.8% - the fastest rate since the market was stimulated by the homebuyer tax credit in May 2010. In addition, the median price for existing homes rose 9.5%.

The sale of new homes, according to a separate report from the Commerce Department, increased by 2.3%. An increase that is expected to rise and contribute to the growth of the economy for the first time since 2005.

These signs along with the Federal Reserve’s new program to buy tens of billions of dollars in mortgage-backed securities is expected to keep the market moving in a positive direction – one that will climb well into 2013.

While the economy still struggles with unemployment, these improvements are sure to increase consumer confidence and demand. With average interest rates down to 3.72% for a 30-year fixed mortgage, consumers who had postponed buying in the last few years have begun moving into the housing market. This new data will surely continue that trend.

The Renter’s Dilemna: Buy or Rent?

Thinking of returning those gorgeous Louboutin shoes because the rents are going through the roof? Yes, Manhattan renters are being hit with, yet, another decrease in their wallets. Tribeca, Harlem and Soho renters are a few of the worst hit by the rising rental rates. Neighborhoods like Harlem have seen a rising trend in rents for the last couple of months. Some of you have started wondering if it’s time to become a homeowner. Let’s briefly explore that option together....

For some, renting means a simpler life: no mortgage, reduced monthly costs and increase in short-term savings. However, buying can provide you with more rewarding benefits: control over your own home, a fixed* monthly household debt and long term savings. No longer at the whim of your landlord’s demands and ever-increasing rental rates, you’ll enjoy a sense of freedom and stability.

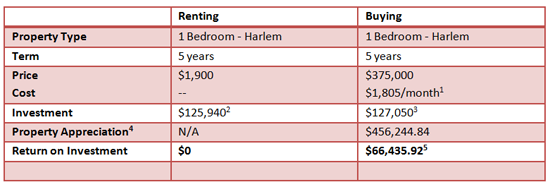

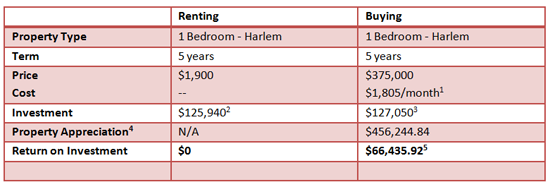

Since you’re likely returning those “red bottoms” anyway, why not consider a long term investment in your future. The pride and benefits of owning your own home can provide much greater rewards than those fabulous, yet short-lived shoes anyway! Take a look at this Rent v. Buy scenario:

Here, we compare the financial implications of both renting and buying a one bedroom in Harlem. With annual rent increases, the debt obligation for renting is virtually the same as owning over the course of 5 years. However, buying alone allows you to benefit from the property's appreciation in value. With property values and mortgage rates at record lows, now is the perfect time to buy!

If you’re ready to make an investment in your future and to take advantage of the sweet freedom that comes along with it, contact a FARE Agent today to explore your options. We look forward to helping you find the perfect home!

* Assumes a fixed-rate mortgage.

2 Mortgage debt only. Assumes 5% down payment and 4.5% mortgage interest rate. Does not include Home Owner Association (HOA) fees, if any.

3 Rent payments over 5 years. Assumes a rent increase of 5% each year.

4 Mortgage payments over 5 years. Includes $18,750 representing the assumed 5% down payment.

5 Assumes a 4% rate of appreciation.

6 Profit after down payment, buyer’s closing costs upon the purchase and seller’s closing costs upon the sale of said property after 5 years.

PLEASE NOTE: These are only estimates offered to help provide a general sense of costs. Please confirm actual costs for specific transactions with your mortgage, tax and/or legal professional.

Here, we compare the financial implications of both renting and buying a one bedroom in Harlem. With annual rent increases, the debt obligation for renting is virtually the same as owning over the course of 5 years. However, buying alone allows you to benefit from the property's appreciation in value. With property values and mortgage rates at record lows, now is the perfect time to buy!

If you’re ready to make an investment in your future and to take advantage of the sweet freedom that comes along with it, contact a FARE Agent today to explore your options. We look forward to helping you find the perfect home!

* Assumes a fixed-rate mortgage.

2 Mortgage debt only. Assumes 5% down payment and 4.5% mortgage interest rate. Does not include Home Owner Association (HOA) fees, if any.

3 Rent payments over 5 years. Assumes a rent increase of 5% each year.

4 Mortgage payments over 5 years. Includes $18,750 representing the assumed 5% down payment.

5 Assumes a 4% rate of appreciation.

6 Profit after down payment, buyer’s closing costs upon the purchase and seller’s closing costs upon the sale of said property after 5 years.

PLEASE NOTE: These are only estimates offered to help provide a general sense of costs. Please confirm actual costs for specific transactions with your mortgage, tax and/or legal professional.

Rental rate and sales price are reflective of a typical one bedroom in Harlem.

Stay Connected…