Thinking of returning those gorgeous Louboutin shoes because the rents are going through the roof? Yes, Manhattan renters are being hit with, yet, another decrease in their wallets. Tribeca, Harlem and Soho renters are a few of the worst hit by the rising rental rates. Neighborhoods like Harlem have seen a rising trend in rents for the last couple of months. Some of you have started wondering if it’s time to become a homeowner. Let’s briefly explore that option together....

For some, renting means a simpler life: no mortgage, reduced monthly costs and increase in short-term savings. However, buying can provide you with more rewarding benefits: control over your own home, a fixed* monthly household debt and long term savings. No longer at the whim of your landlord’s demands and ever-increasing rental rates, you’ll enjoy a sense of freedom and stability.

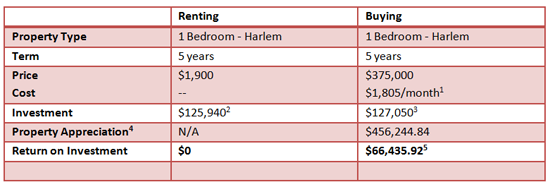

Since you’re likely returning those “red bottoms” anyway, why not consider a long term investment in your future. The pride and benefits of owning your own home can provide much greater rewards than those fabulous, yet short-lived shoes anyway! Take a look at this Rent v. Buy scenario:

Rental rate and sales price are reflective of a typical one bedroom in Harlem.

Here, we compare the financial implications of both renting and buying a one bedroom in Harlem. With annual rent increases, the debt obligation for renting is virtually the same as owning over the course of 5 years. However, buying alone allows you to benefit from the property's appreciation in value. With property values and mortgage rates at record lows, now is the perfect time to buy!

If you’re ready to make an investment in your future and to take advantage of the sweet freedom that comes along with it, contact a

FARE Agent today to explore your options. We look forward to helping you find the perfect home!

* Assumes a fixed-rate mortgage.

2 Mortgage debt only. Assumes 5% down payment and 4.5% mortgage interest rate. Does not include Home Owner Association (HOA) fees, if any.

3 Rent payments over 5 years. Assumes a rent increase of 5% each year.

4 Mortgage payments over 5 years. Includes $18,750 representing the assumed 5% down payment.

5 Assumes a 4% rate of appreciation.

6 Profit after down payment, buyer’s closing costs upon the purchase and seller’s closing costs upon the sale of said property after 5 years.

PLEASE NOTE: These are only estimates offered to help provide a general sense of costs. Please confirm actual costs for specific transactions with your mortgage, tax and/or legal professional.

Stay Connected…